SMITA and Bipin have been seeing a lot of articles in the newspapers lately, about financial planning. They wanted to see whether there was anything they could do to meet their family’s financial goals through a disciplined approach to investing. They are well informed on financial matters, and save regularly. But they nevertheless wanted to know whether they could do better.

Bipin was bursting with questions. Was his and Smita’s life insurance cover adequate? Should they invest in unitlinked insurance plans of private insurance companies? Should they sign up for a unit-linked pension plan?

In order to answer these questions, we had a long and detailed discussion about the state of their financial affairs, and listed their assets (see assets table).

The Phadkes had no direct investments in the stock market, but had recently started investing in mutual funds through systematic investment plans (SIPs). We thought their equity exposure was on the lower side, considering the overall picture of their assets.

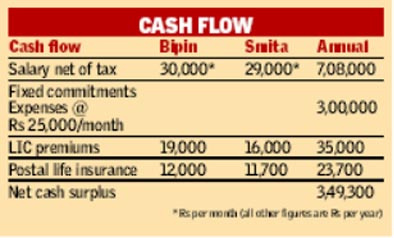

On analysing their present cash flow (see cash flow table), we concluded that the large outflow on account of life insurance premia was not justified by the relatively low cover.The total life insurance cover for Bipin and Smita was Rs 5 lakh each, for which they paid a total premium of Rs 58,700 each year. It seemed to us that this otherwise well-informed couple had not thoroughly grasped the concept of life insurance cover, as they were not only underinsured, but were paying too much.

Of their cash surplus, the couple are committed to invest Rs 5,000 each month in equity funds through SIPs, leaving a substantial surplus that could go a long way in improving their financial position between now and retirement—a period of almost 20 years.

We identified some key issues the Phadkes needed to address. The first of these was risk management—ensuring adequate life insurance for both earning members. The second issue was to build short-term capital for the education of their daughter Mrinmayi, who is now nine years old. The third was to build long-term capital building for Mrinmayi’s higher education, wedding, and other future needs. And fourthly, both Bipin and Smita would get a pension when they retired, but retirement planning was still essential as the pensions may not be adequate to maintain their standard of living.

We advised the Phadkes to increase their life insurance cover by Rs 25 lakh each. We suggested they opt for a term assurance plan of any life insurance company, for a term of about 20 years. We chose this term to coincide with their retirement. The additional cover would entail a total cash outflow of about Rs 35,000 a year for both of them together—a small price to pay for risk management, when you think about it.

One of the safest ways for a conservative investor to build capital continues to be the Public Provident Fund account. Considering the invested amount qualifies for exemption under Section 80C of the Income Tax Act, and the interest rate of 8% a year (interest is also tax-free), the yield on PPF works out to 16.3% a year for an individual who falls into the 30% tax bracket. The Phadkes were already investing Rs 70,000 a year in each of their PPF accounts, and we suggested they continue to do so.

Some private insurance companies offer unit-linked pension plans, which invest your entire premium in stocks and bonds as per your choice. The biggest irritant in unit-linked insurance plans has been the high administrative expenses/selling expenses in the first couple of years. The present plans with 100% allocation can be considered

investor-friendly. We recommended investing Rs 10,000 a month for both of them in this the unitlinked pension plan of LIC, with a total allocation to equity funds at this stage. We suggested a term of 20 years. These plans allow investors to switch their preference from equity to balanced to debt funds without any loads, for a limited number of times in a year. From the investor’s perspective, this is good because it makes for flexibility in planning one’s asset allocation. Our objective in recommending the above was to build retirement capital the risky, aggressive way (with option to reduce risk as Smita and Bipin grow older), as opposed to PPF, which is a safe, slow and steady way.

The Phadkes plan to c o n t i nu e with their e x i s t i n g SIPs , contributing Rs 5,000 per month in diversified mutual funds. But we suggested an addition of about Rs 6,000 per month, given available liquidity, to build up short- and long-term capital, mainly to meet little Mrinmayi’s education and marriage expenses.

In this planning process, we ensured that all the financial goals of this conservative middle-class family would be met in a systematic way, with a blend of conservatism and aggression. The Phadkes appreciated our balanced approach, and agreed to implement the plan. We will be reviewing it on a periodic basis.

D Sundararajan is Certified Financial Planner and Investment Consultant, Trendy Investments

MEET THE FAMILY

Smita and Bipin Phadke are both medical professionals. They are in pensionable service. Bipin is 41, and Smita is a year younger. The couple live with their daughter, nine-year-old Mrinmayi. They have no other dependants. Both Smita’s and Bipin’s parents live independently